An Introduction Into Retirement Accounts

IRAs, 401(k)s, and HSAs

Last modified: 9-28-2025

When looking into personal finance for the first time, I found it stupidly difficult to find concrete information about retirement accounts. This article aims to provide a starting point about the different sorts of retirement accounts, as well as mention basic retirement account strategies. Note that I'm not a financial advisor, and that all information here should be double-checked.

When should you have retirement accounts?

Not everyone should have retirement accounts. However, you should if:

- You plan on retiring.

- You have any extra income that you're comfortable with investing.

The second point is the harder one, and should only generally be considered after you build an emergency fund (some money that's easily accessible). People typically recommend three to six months of living expenses as an adequate emergency fund, although this number depends on your living/financial situation.

But if you can afford to invest your money, you probably should. If the alternative is leaving that money in a checking account because it's "safer", remember that inflation eats roughly 2-3% of it every year. Something you can do instead is invest that money, which across many years will have yields that significantly beat inflation. Retirement accounts are a good way to invest money as they're more tax efficient than a normal brokerage account. As such, the primary goal of retirement account strategy is figuring out how to invest in a way that minimizes taxes.

Roth IRA

What is a Roth IRA?

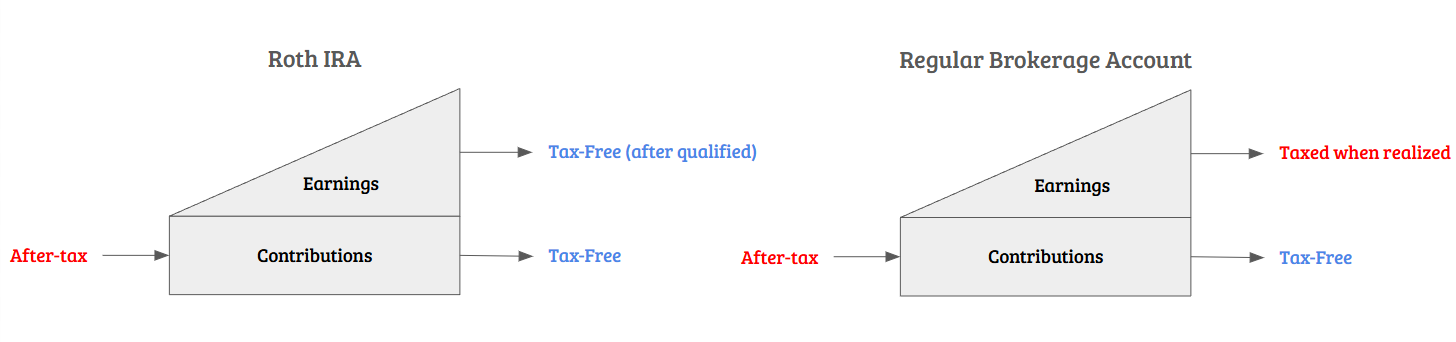

If you know nothing about retirement accounts, a Roth IRA is the easiest place to start. How the Roth IRA works is that you contribute after-tax funds. That money is invested, and once you turn 59½ years old, the earnings can be taken out tax-free and penalty-free.

Compare this to a regular brokerage account, where you contribute after-tax funds, and any realized gains (gains from investments) are taxed.

There's a few other important details about the Roth IRA:

- Contributions can go up to the annual limit or your taxable compensation for the year, whichever is less. As of 2025, the annual limit is $7,000 ($8,000 if at least age 50).

- Contributions can be withdrawn at any time tax-free and penalty-free. Withdrawn contributions still count for the yearly contribution limit.

- Earnings can be withdrawn tax-free and penalty-free so long as you're at or over the age of 59½ and the account has been open for at least 5 years. Attempting to withdraw earnings under the required age limit leads to an early withdrawal fee of 10% as well.

- If your Modified Adjusted Gross Income (MAGI) is too high, you're ineligible to directly contribute (there are ways to bypass this which will be discussed later).

This is probably the easiest place to start investing. It's with after-tax funds, which means that there's no extra tax complications. The bar for eligibility is low too—as long as you have taxable compensation and are under the MAGI limit, you're eligible to contribute.

Creating a Roth IRA

A Roth IRA can be set up through a brokerage provider. Here's some possible options:

- Fidelity

- Vanguard

- Charles Schwab

- Robinhood

- This is only here due to their 3% IRA match. The catch is that it's Robinhood.

People seem to spend too much time on this decision. The bottom line is that it doesn't matter. There's hardly any differences between the providers other than their interface and marginal differences in what you can invest in with them. Plus, you always have the option to switch to a different provider later.

Roth IRA Investment Strategies

Once you put money into a Roth IRA, the next (easily forgettable) step is figuring out what to invest the money in. People typically recommend buying index funds, which is effectively a collection of multiple stocks. The current popular option is the S&P 500, an index fund that tracks the top 500 companies in the US. I shouldn't offer any more advice past this, so here's a few links that may help with decision-making:

- Fidelity Investing ideas for your IRA

- Bogleheads Asset allocation

- Youtube video by The Money Guy Show

The TL;DR is that what you choose to invest in should depend on your age and risk tolerance.

Similar to above, this isn't something worth spending very long dwelling on. In the Roth IRA, you can freely change investment positions without taxes or penalties. On the other hand, you should refrain from changing positions too much, if these changes are a result of current market trajectory. The ideal scenario is to find a strategy that works for you, and then stick with it no matter what's currently happening in the market.

Traditional IRA

What is a Traditional IRA?

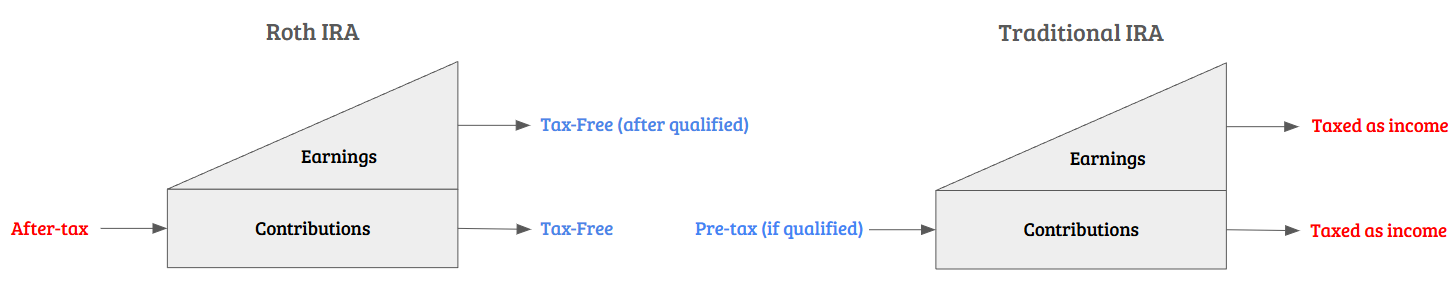

There's a number of differences between a Traditional IRA and Roth IRA. For simplicity, I only focus on one difference here, which is how they're taxed differently. Trad IRA contributions are pre-tax, meaning that they're deductible from your income. Any growth is tax-deferred, meaning that it's only when you withdraw any funds that those funds are taxed as income.

Otherwise, the Trad IRA and Roth IRA are similar:

- Both have the contribution limit of $7,000. Note that this limit is shared across the IRAs.

- Both have an early withdrawal penalty. One difference is that in the Trad IRA, contributions cannot be withdrawn early penalty-free (barring exceptions).

I claimed earlier that Trad IRA contributions are pre-tax. Unfortunately, this is not true if you have a retirement plan at work and if your MAGI is at least a certain amount. The limits for 2024 are defined here. If your Trad IRA contributions are nondeductible (meaning not deductible from your income), you should always prefer contributing to a Roth IRA instead.

Backdoor Roth IRA

Earlier, I mentioned that the Roth IRA prevents people with high income to directly contribute. The limits for 2024 are explained here. What you can do instead is contribute those funds to a Trad IRA, and then immediately rollover those funds into a Roth IRA. This is known as the "backdoor Roth IRA", and it's called a backdoor as it's a legal loophole.

If this is the first time you've heard of this, it probably sounds really stupid. It is stupid. Doing this backdoor method yields the exact same result as a direct contribution. The process is also easy enough to where most brokerage providers will handhold you through the process.

One caveat is that filing taxes becomes marginally harder. Also, if you do a backdoor, you should make sure that your trad IRA is initially empty. This is due to the pro-rata rule (which isn't worth explaining here). It's still a very simple process, so it's an option to definitely consider if your income is too high for direct Roth IRA contributions.

401(k)

What is a 401(k)?

Some employers offer a 401(k), a retirement account, to employees. What employees can do is take a portion of their paycheck and contribute that directly to their 401(k). The annual contribution limit for employees is $23,500, as of 2025.

Types of 401(k)s

Employees can choose one of two types of the 401(k), that being either the Roth 401(k) or Traditional 401(k). These types should look similar, because they're the same types of accounts for IRAs. Tax-wise, they behave basically the same way:

- For the Roth 401(k), after-tax funds go into the account. That money is then be withdrawn later tax-free.

- For the Traditional 401(k), funds go in pre-tax. That money is taxed as income when withdrawn.

One difference between the 401(k) and IRA is that because the 401(k) is supplied by the employer, your investment options in the accounts will probably look different. If your plan is to invest in index funds, this ultimately shouldn't matter too much to you.

Employer Match

Some employers offers a matching contribution. The type of match depends heavily on the employer, but the usual format is based on how much you personally contribute and your salary. One example might look like "50% of employee's contributions up to 6% of salary".

One thing to note is that the employee contribution limit does not include your employer's match. There's a separate limit for the employer + employee total contribution, that being $70,000 as of 2025. So you don't need to worry about "maxing" out your employer match, or doing math to hit exactly the employee contribution limit number.

The takeaway is that if your employer has a contribution match, this is the first priority for retirement account contributions. This is essentially free money that your employer is giving you, so you should be trying to maximize their match.

Health Savings Account (HSA)

What is an HSA?

An HSA is another savings account, this one moreso used for medical expenses. You can only have an HSA if you are enrolled in a High-Deductible Health Plan (HDHP), which may be offered by an employer or enrolled in individually. Just like the other accounts here, HSA funds can be invested.

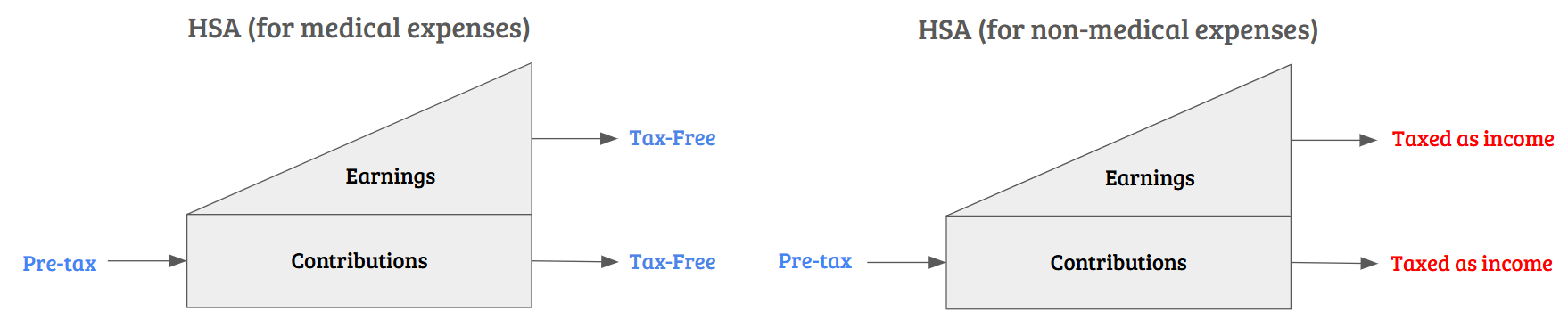

How the taxes work for the HSA is that you contribute pre-tax funds to it. At any point, you can withdraw funds for qualified medical expenses tax-free. If the withdrawn funds aren't for medical expenses, then you pay the income tax on withdrawals if at least age 59½. Otherwise, you also pay the early withdrawal fee.

This technically means that the HSA is the best retirement account (barring certain states). If you only use it for non-medical expenses, it matches the strength of a Traditional account. However, you should expect to have significant medical expenses during retirement, which makes this account very valuable.

Reimbursing Payments

When paying for medical expenses with an HSA, there's two main ways to go about it. The first way is to have expenses directly pulled from your HSA account when the purchase is made. The other way is to pay out-of-pocket, then reimburse the purchase using your HSA at a much later date.

Optimally, the reimbursing payments option is better due to compound interest (assuming you can afford to pay out-of-pocket). However, in order to reimburse the payment, you also need to keep track of some proof of purchase, in case you're ever audited by the IRS. What this effectively means is keeping track of dozens of receipts across many years. Whether the extra HSA funds is worth the effort is up to you.

US Health Plans

If you aren't yet enrolled in a health plan, you may be considering enrolling in a HDHP for access to an HSA. Unfortunately, the US health system is its own headache to learn about. If you don't know about terms like deductibles or coinsurance, then you should learn about that before enrolling in a health plan. This information is outside the scope of this post, but here's a couple of resources about this:

The point of mentioning this is that since HDHPs have a high deductible, it may not be worth it for people with major medical expenses.

Choosing Roth vs Traditional

One question that you might've thought of while reading this is wondering whether to choose to pick a Roth or Traditional retirement account. Unfortunately, this is a question that's really hard to answer. This decision depends on factors such as:

- When you plan on retiring

- How much income you'll need during retirement

- What tax brackets will look like in the future (an impossible problem to solve)

- How you plan on dealing with required minimum distributions (not worth explaining here)

Ultimately, this should be a discussion with a financial advisor. However, I explain here some basic strategies which are probably good enough for most people just starting to contribute to retirement accounts.

The naive strategy that most people use is that they roughly estimate how much taxable income they expect to have in retirement. Then, if they're currently making more than that amount, they choose Traditional. Otherwise, they choose Roth. The justification here is that taxes should be paid whenever your taxable income is less, which is honestly good enough for most people.

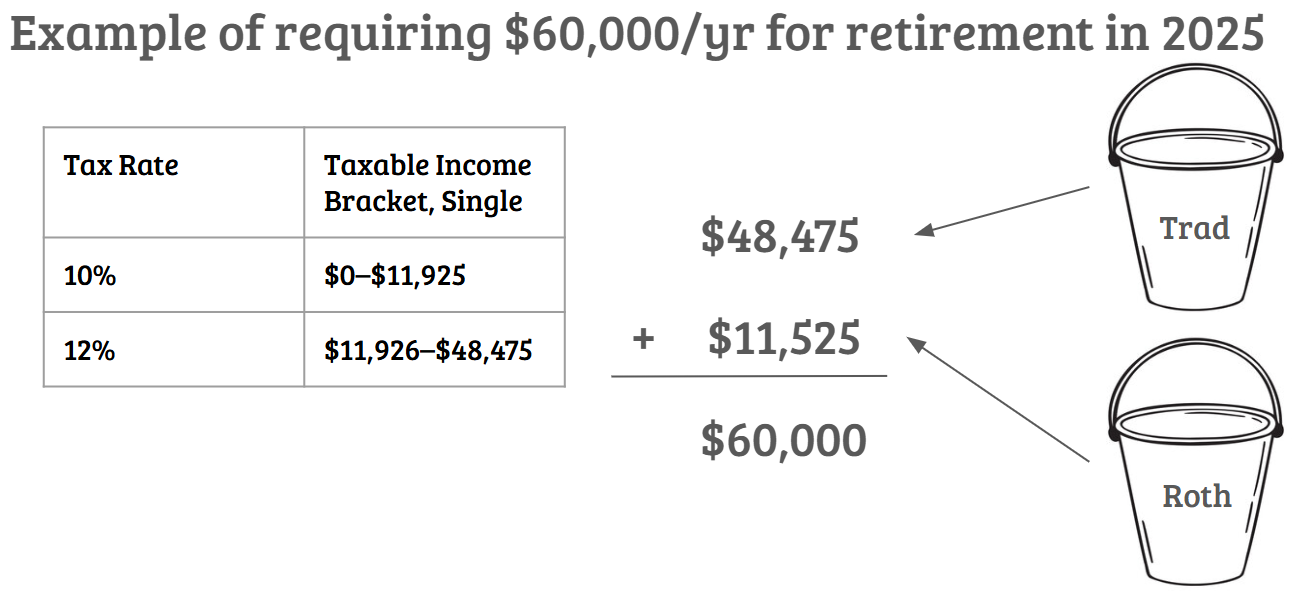

Also, it'll probably be useful to have both Traditional and Roth funds. The idea is to mentally separate these into individual "buckets". Then, during retirement, you can take some funds out of the Traditional bucket within a certain tax bracket, then supplement that taxable income using your Roth bucket. As a basic example:

Again, choosing between Traditional and Roth is a complicated problem, but the strategies above provide a good starting point.

Conclusion

There's a lot more to discuss, but I assume this is sufficient knowledge for anyone just starting to get into retirement accounts, or investing in general. As this is targeted for beginners, this post isn't nearly exhaustive of everything you should know. Nevertheless, I hope this post is useful for anyone starting out.